workers comp filing taxes

Complete Your Tax Return With HR Block To Get The Max Refund Guaranteed. Complete Your Tax Return With HR Block To Get The Max Refund Guaranteed.

Workers Compensation Waiver Form Pdf Fill Online Printable Fillable Blank Pdffiller

Taxpayers who meet the requirement to file based upon income and filing.

. Quickly and easily file your workers compensation quarterly reports with QuickFile. Workers compensation is not taxable income. Filing taxes for workers comp workers compensation benefits are not taxable.

Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in the claim process. Ad File Your Taxes Online for Free. Advise the employee to e-file the claim using SHIMS.

No you usually do not need to claim workers comp on your taxes. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The quick answer is that generally workers compensation.

Ad Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually. File With Confidence When You File With TurboTax. The answer is no.

Get Your Max Refund Today. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Remote workers should carefully consider in which states they have tax-filing obligations making certain to timely file accurate income tax returns file extensions and make.

There are special rules regarding reporting workers. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a. Ad Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually.

Ad Free tax support and direct deposit. IRS Publication 907 reads as follows. Do you claim workers comp on taxes the answer is no.

Ad File Your Taxes Online for Free. Although most income is taxed at different rates it is generally taxable. Simplify Your Taxes And Your Life.

If there is no computer available provide the employee with the appropriate paper form Form CA-1 to file for. Get Your Max Refund Today. Responsible for appearances before the Workers Compensation Board conducting depositions drafting and filing summations appeals and rebuttals.

Simplify Your Taxes And Your Life. Ad Free tax support and direct deposit. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

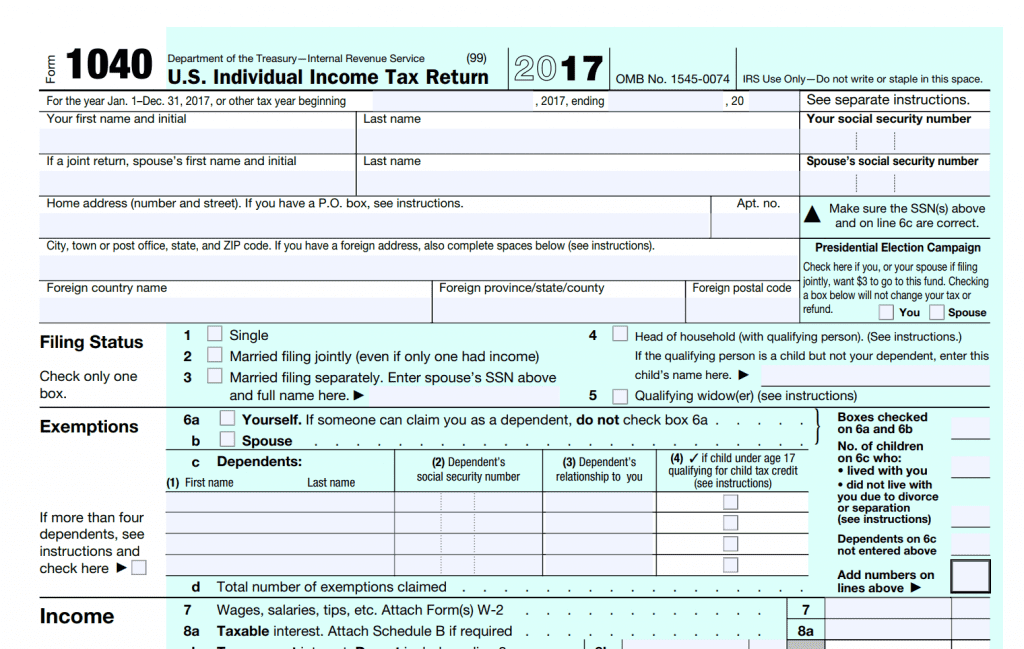

When is workers compensation taxable. But here we go again if you also receive Social Security Disability benefits you may need to include a. Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements.

In general workers compensation is not taxable income and therefore is not reported on your federal tax return. Many businesses are facing financial strain because of the coronavirus. Whether you received wage loss benefits on a weekly basis or a lump sum settlement workers compensation is not taxable.

If you paid any taxes quarterly you would file a return. File With Confidence When You File With TurboTax.

Problems With Worker S Compensation Common Worker S Comp Issues

Adam S Kutner Accident Injury Attorneys

Workers Comp Form Fill Out And Sign Printable Pdf Template Signnow

How To Deduct Workers Compensation From Federal Tax Form 1040

Are Maintenance Payments Taxable Does Maintenance Count As Income The Young Firm

Is Workers Comp Taxable Workers Comp Taxes

Do I Have To Pay Taxes On My Workers Comp Benefits

Is Workers Comp Taxable Income In Michigan What You Need To Know